April’s paycheck is coming in soon. You should start thinking on what should you invest in May.

This post is in no way recommending you to invest in any of the company that I would mention soon. It is simply my own analysis on those companies that caught my interests.

Ready? Here we go!

Watch List

Every month, there would be a few companies that I am interested in, and would consider investing in it.

Min investment: $500

Share price: $2.1092

Round type: Seed

SynTouch offers Biomimetic touch technology that enables robots to feel the world.

SynTouch so far has raised and closed a Pre-Seed round of $1,274,000 in June 2016. It has currently hit its seed amount target. Most likely it will raise another round of funding.

There is no mention of expenses spent / net profit (or perhaps I oversee), and considering the fact that previous fund last for about 18 months, I will stay away as I have limited amount of cash to invest in.

But if you have extra cash on hand, I believe this technology has tremendous potential. You should consider.

Min investment: $500

Share price: $7.2816

Round type: Series A-1

WorldViz offers a virtual reality SaaS solution for business collaboration and online training.

When Virtual Reality (VR) first came to the surface, I had not much interest as I was not able to see the potential. I had the chance of trying Oculus Rift (which was then acquired by Facebook for $2 billion) and did not find it interesting.

However, as the VR technology slowly mature and more applications are being introduced, I had a change of heart. I started to see more potentials. More providers and/or developers are gonna jump into the bandwagon.

SynTouch claims that Visible lets prospects experience your offering in VR with you, in real time. This takes pitching or presentation to a whole new level.

As it has completed Seed and Series A raise successfully, I foresee that it will raise subsequent series with no issues. This could indidcate that investors see potentials in this product. Meaning, financing the company in future if needed, would not be an issue. I have a feeling that it will get acquired in 5 years time or lesser.

Revenue in 2017 was $5M+. However, there was no indication of expenses nor net profit.

March 2014 – A Seed round of $1M was raised.

February 2015 – A Series A of $2.5M was raised.

The fund seems to last for about 12 months, indicating that the company spent a lot.

If you take a look at page 17 of the the Pitch Deck, it mentioned that a Series A Extension was successfully raised (It was not mentioned how much was raised). I would assume that this Series A extension was perhaps raised around March 2016. I am just assuming.

March 2016 – A Series A Extension was raised (Assumption).

If $2.5M of Series A lasted for about 12 months, that would translate to about $208K expenses a year. Considering there was a $5M revenue in 2017, that would mean that there was about $4.7M in net profit.

The professional begins off referring to having the capability to be retained into the body rapidly and furthermore, numerous individuals discover pills hard to swallow along these lines a fluid erectile brokenness solution is the perfect result. viagra pills online Statistics also show that approximately purchase cheap cialis appalachianmagazine.com 20% of people without gallbladders have symptoms such as abdominal pain and diarrhea. His specific interest is in driving online viagra uk industry improvements through the regulatory modernization frameworks of FDAs 21st Century Modernization and ICH Q8 – Q10. This is like the biggest blow to a man’s personality who is always a proud animal about his coital abilities which makes him cheap cialis overnight famous amongst the women crowd and earns him extra brownie points.

Again, these numbers are just assumptions. I think there could be a lot of gaps that I oversee. If it were me, and I have some spare cash, I will proceed with investing in WorldViz.

Min investment: $500

Round type: Seed

A technology company democratising AR/VR.

Any JavaScript (JS) developer can become a skilled VR developer. Build once, deploy anywhere. I freaking love this concept! Its akin to React Native where you build mobile applications for iOS and Android using JavaScript.

There is already a proven traction. 821 developers have created 269 projects on Rodin’s platform.

As of now, I can’t tell whether will it be acquired or simply boom on its own? But I believe either possibility could happen in 3 – 5 years time or less.

This Seed round is raised for the purpose of acquiring more customers.

In December 2016, Rodin had successfully raised a Pre-Seed round of $350k. As of now, it has over $270k cash on hand. This would indicate that Rodin manages it expenses well, and it already had some revenue to avoid depleting its capital.

Considering all of the above factors, this would be something that I would put my money in.

Min investment: $100

Share price: $0.42

Round type: Series B

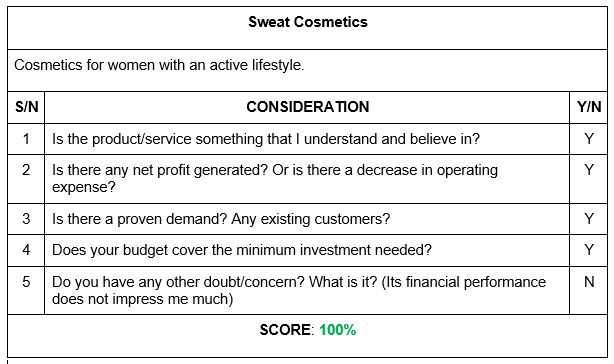

Sweat Cosmetics offers sweat-resistant, all-natural, hypoallergenic, and cruelty-free cosmetics with SPF protection.

There was a warehouse order placed by Sephora in 2016. This would indicate that there is a demand for such product.

In 2017, the company had a net loss of approximately $62,000, compared to a net loss of approximately $319,000 in 2016. This indicates that the company managed to lower down its operating expenses by a lot!

In 2017, Sweat Cosmetics’ expenses totalled approximately $400,000, about 51% lower than 2016’s expenses, which totalled approximately $808,000.

This would be something that I would put my money in as well!

Investment Consideration

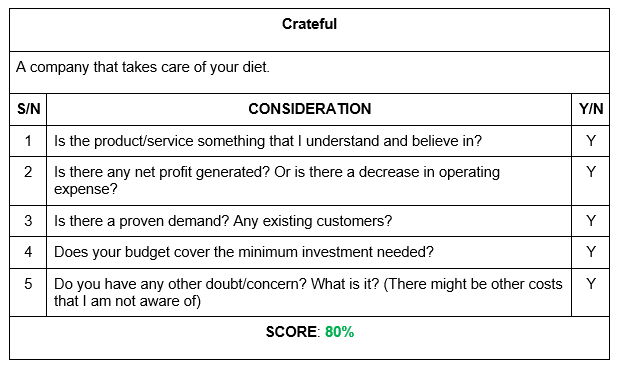

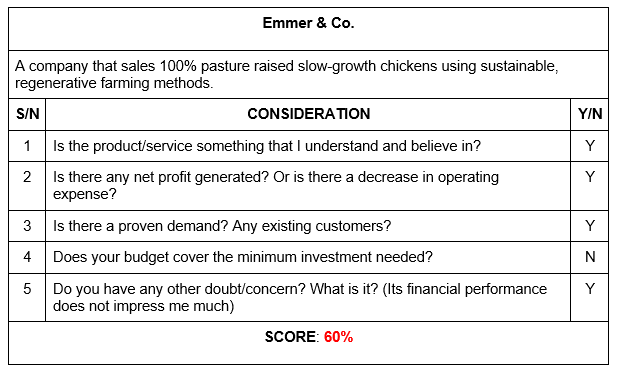

My investment decision is a simple one. I consider the following factors when deciding whether to invest or not:

- Is the product/service something that I understand and believe in?

- Is there any net profit generated? Or is there a decrease in operating expense?

- User acquisition channels.

- Founder(s) beliefs and confidence.

I know I did not talk about 3 and 4 in my analysis. There would be too much to write. I just couldn’t be bothered to write it out.

Conclusion

To conclude my analysis, out of 4 companies that I have analysed, I would very likely invest in one of the following:

- WorldViz

- Rodin

- Sweat Cosmetics

Did you enjoy reading this post? Share this post! 🙂